What good is $1,000,000 if you’re dead?

In this day and age, people are living longer and longer. Advances in medicine and more awareness about healthy choices have us living till we are 100+ years old.

Despite all of this, there are still times that we are taken from this earth way too soon. The below are just a handful of examples of the grim realities.

- 21 year old college student dies of bacterial meningitis.

- 40 year old mother of 2 dies in a car accident.

- 50 year old father of 3 dies of a heart attack.

None of the above people had any warning that they were going to die early. What if they were prepared for the worst?

Life insurance is the one thing you pay for and never want to actually use. It works much the same way a seat belt does. In order for it to be effective, it has to be in place before something goes wrong.

Going back to our original question – what good is $1,000,000 if you are dead?

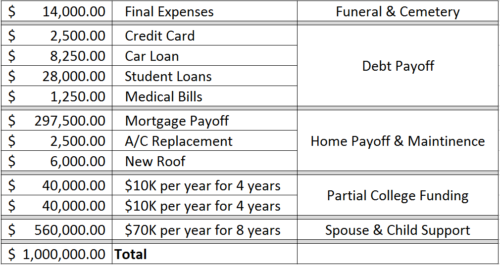

Nancy (43) is the family’s breadwinner. She earns a salary of $95K per year. Peter (44), her husband, stays at home and takes care of their 2 kids (11 and 13). One day, Nancy is involved in a tragic car accident and doesn’t make it. Here is where that $1,000,000 life insurance policy she purchased 5 years ago comes into play.

This oversimplified calculation takes into account many things that Nancy would have paid for had she still been around. The $1,000,000 supplements part of her future earnings.

How would your family fare if one of you were to suddenly pass?

Would you put your kids future into the hands of a regular insurance agent? If they sell a more expensive policy, they make more money. However, more expensive doesn’t mean its a better policy.

- That’s why we charge a fee to figure out your situation.

- By law, we have to put your interests ahead of ours (Fiduciaries).

- We don’t try to sell you a larger policy to make more money.

- 34+ years of experience means we don’t overlook the details.

-Martin Konsor

P.S. Have friends with new additions to their family? Share this with them below!