How Can A Realtor With $3M at 55 Save $6M By 65?

Panic, worry, and confusion are what someone with $3,000,000 feels when they know they need $6,000,000 for a comfortable retirement.

Gary has been in Real Estate since he was 25. Throughout the years his work evolved until he owned his own company. It’s taken him 30 years of hard work, blood, sweat and beers (not a typo) to amass a total savings of $3,000,000. He’s 55 and needs about $6,000,000 by the time the big “six-five” rolls around.

What can he do with $3,000,000 in 10 years that allows him to reach his goal?

First strategy is to save another $3,000,000 in ten years, about $300K per year. On a salary of $250,000, this is where the panic, worry, and confusion set in.

“There’s no way I could possibly put away that much! I have to finish paying off my business equipment loan, I’m paying for 3 kids’ college, and the bills keep rolling in.”

What can he really manage? “I could put away about $80,000 a year”. That gets his $3,000,000 to a measly $3.8M – well short of what he needs.

Let’s explore what happens when he finds an investing strategy that works for him. He decides to invest in mutual funds and over the course of his 10 years’ time, the ups and inevitable downs average out to about 6% per year.

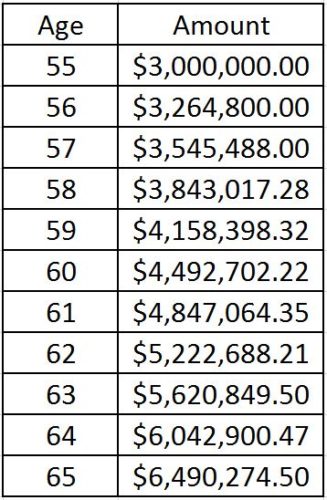

Each year he adds $80,000 and it grows by 6%. This is what happens from 55 years old to 65:

Wait – is that $6.49 Million?! It sure is –almost half a million dollars over his goal! Although he added only $800K total over those years, his money grew over $3M because it was invested properly.

For Gary, there was no reason to panic, worry or be confused. There was also no reason to reinvent the wheel. By working with someone who had his best interest in mind, he invested appropriately in mutual funds, minimized his risk, and stuck with his strategy. Gary hit his goal and beyond. There was absolutely a chance he could have lost money, but in his case it worked out over 10 years.

Talk to our team about where you stand today and what you have your money invested in. You may be closer to your goal than you think!

By Martin Konsor

Woodfield Financial Advisors